Hawkins on Wall Street Meltdown

Syracuse Post-Standard

September 16th, 2008

Political Notebook

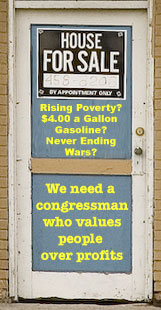

Howie Hawkins, the Green Populist candidate for Congress in the 25th District, said Tuesday that the collapse of three of Wall Street's biggest financial firms over the weekend "highlights the need for a populist and green restructuring of the economy so it serves the interests of the vast majority, not the privileged few."

Hawkins said that this restructuring should focus on a new green industrial policy and populist economic policies. The industrial policy would transfer much of the federal budget now spent on the military-industrial complex to investments in a new green infrastructure for the economy. The populist economic policies would focus on democratic regulation of the financial sector and tax and spending policies that promote a fairer distribution of income and wealth.

Hawkins said:

"This crisis is what you get when politicians bought and paid for by rich corporate interests radically deregulate the economy and allow capitalists to speculate like compulsive gamblers. It's not just the rich who are losing wealth with the collapse of securities inflated by highly leveraged speculation backed up by few underlying real assets. Working people's homes, pensions, retirement savings, and overall living standards are collapsing, too.

"Congress' failure to adequately supervise Wall Street and the various financial scam artists is rapidly turning the US into a second-rate economic power while greatly devaluing the dollar, which then further pushes up the price of oil and other imports."

Hawkins attributed the crisis to underlying structural problems in the U.S. economy that the deregulatory policies of recent decades made worse.

"The US and indeed world economy have had excess capacity in most industries since the 1970s. There is no reason to build new production plans when existing plants can produce more than can be sold. The tax and regulatory cuts for the corporations and wealthy individuals promoted by both ruling parties in the US for 35 years were supposed to stimulate investment in the real economy of production and thus create jobs and benefits for all. The reality is that without many opportunities for profitable investments in production, the rich have taken their tax cuts and invested the money to rearrange ownership of existing real assets. Mergers and acquisitions, speculation in securities, subprime mortages, usurious credit card lending, hedge funds, and commodity speculation are all part of it. Profits in the financial sector accounted for around 15 percent of total profits in the post-war period before 1970 and had grown steadily to over 40 percent of total profits by the 2000s. The financial sector used to facilitate production. Now it is a parasite on the real economy of labor and industry."

"We need to re-regulate the financial sector so it can serve the real economy of production and supplement private investment with a substantial increase in strategic public investment in the real economy. Every economic boom in the history of industrial economies has been founded on building infrastructure and manufacturing associated with a new set of technologies, like steam-powered manufacturing and railroads, electrification and mass consumption of automobiles, suburban housing, and home appliances, and, more recently on a lesser scale, the information technologies associated with computers and cell phones. The way to get the economy going again and put people back to work is massive investment in a new real economy based on green principles of ecologically sustainable production. We need to rebuild or retrofit every thing on a green basis, from renewable energy and solar-powered railways to our buildings and manufacturing processes. We need to do that for climate stability and energy security as well as economic revitalization."