Hawkins Calls for New Public Housing; Protect Homeowners Facing Foreclosure

Howie Hawkins for Congress

25th District, New York

www.howiehawkins.org

Media Release

For Immediate Release: Friday, October 31, 2008

For More Information: Howie Hawkins, 315-425-1019, hhawkins@igc.org

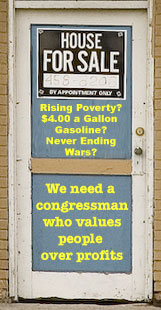

Howie Hawkins, the Green Populist candidate for Congress in the 25th district, called today for increased Congressional action to protect homeowners from foreclosure while dramatically increasing funding for public housing and affordable housing programs such as Section 8.

"The Congressional response to the home foreclosure crisis should start with protecting homeowners, not bailing out the unscrupulous financiers who preyed upon mortgage borrowers. Bailing out the predatory lenders only reinflates the housing bubble and makes housing less affordable. It encourages more predatory lending and debt expansion, setting the stage for another financial meltdown when the inflated home mortgage costs cannot be met by over indebted borrowers. At least $50 billion should be targeted to help keep people in homes facing foreclosure through refinancing and creating new homeownership and housing opportunities. Congress must also get back into the business of helping tenants. Innocent tenants need to be protected from the foreclosure crisis. President Reagan fatally wounded affordable housing programs with drastic funding cuts America 25 years ago. These cuts needed to be finally reversed," said Hawkins.

In 1978, before President Reagan took office, the annual budget for the U.S. Department of Housing and Urban Development (HUD) was $83 billion. In 1983, during the middle of Reagan's first term, the HUD budget had been recklessly slashed to only $18 billion.

"About the only public housing built in Syracuse since Reagan took office is the new jail downtown. We are losing affordable housing at an alarming rate in Syracuse† Cherry Hill, Kennedy Square, several James Street apartment buildings, Presidential Plaza. These projects were built with tax breaks for developers rather than as community-owned public housing as a result of privatization policies in housing initiated during the Nixon administration. It is certainly obvious now that that experiment failed. Our public housing has far outlived the affordable housing built with tax breaks for developers, who did not maintain their buildings once the tax breaks were taken. Itís time to start building public housing again. Low-income people need it for decent shelter and we all need it now as an economic stimulus to recover from the financial meltdown," Hawkins said.

Among the homeowners protections that Hawkins wants Congress to enact are:

1. Restructuring mortgages for distressed homeowners. Any financial institution that participates in the federal bailout must be required to extend affordable mortgage restructuring to homeowners facing foreclosure. The modification program recently enacted by the FDIC and the depression-era Home Ownership Loan Corporation should be the models. This provision would apply to any home mortgage, either wholly owned or included in securities owned by the institution. If the Bush administration could change the short selling rules of the financial markets overnight to protect banks from short sellers, then they can change the rules governing failed financial instruments to protect American homeowners from foreclosure.

2. Bankruptcy shelter for homeowners. Congress should amend the bankruptcy law to allow homeowners to restructure their home mortgages in bankruptcy and save their homes. Americans who take out loans to purchase cars, boats, and even investment properties can file for bankruptcy protection and have a judge restructure their payments. But that's not the case with their home mortgages. Since 1978, bankruptcy laws have prohibited judges from adjusting loans on a "principal residence."

3. Extend the Community Reinvestment Act (CRA) to investment banks, mortgage banks, and insurance companies. The Community Reinvestment Act has been blamed by some for forcing banks to make risky loans. But it was non-bank financial institutions that were not covered by the CRA that made most of the predatory sub-prime loans. CRA banks were substantially less likely than other lenders to make the high cost loans that fueled the foreclosure crisis, according to a January 2008 study by Traiger & Hinckley, a New York City-based law firm that advises financial institutions on compliance with federal and state anti-discrimination laws. Any financial institution that benefits from government assistance must be required to provide in return public benefit by investing in low- and moderate-income communities in accordance with CRA's mandate that banks serve the credit needs of their local communities consistent with safe and sound banking practices.

As the foreclosure crisis deepens, the rising number of foreclosures involving rental property has negatively impacted upon tenants.† Tenants often receive little or no warning of the property owner's foreclosure and resulting eviction. These summary evictions are particularly hard on lower income tenants who may not have the resources to move, and on Section 8 voucher-assisted tenants who must find a new owner willing to enter into a Section 8 contract. Hawkins said he supported legislation in both the House and the Senate that would provide a minimum of 90 days' notice and specific protections for Section 8-assisted tenants (H.R. 5963, S. 3034, Protecting Tenants at Foreclosure Act of 2008).

Hawkins also called for a reestablishing the Postal Savings Bank, the US Postal Serviceís depository service that served low-income working people from 1911 to 1966. It is needed, Hawkins said, for people who have no banks in their towns or neighborhoods, who cannot afford the minimum deposit requirements of commercial banks, or who need an alternative to predatory check cashing, payday loans, and pawnshops.

Hawkins said he supported the goal of the National Low-Income Housing Coalition for the federal government to increase its investment in housing in order to produce, rehabilitate, preserve, and/or subsidize at least 1,500,000 units of housing that is affordable and accessible to the lowest income households in the next ten years.

Hawkins said that the Housing Trust Fund established by the Housing and Economic Recovery Act of 2008 was a good first step and should be expanded. It is a new federal housing program that will provide funds to state governments for the purpose of building and rehabilitating homes for the very lowest income people in the United States. The Housing Trust Fund is the first new federal housing production program since 1974 that is specifically for extremely low-income renter households. Today in the United States, there are 9 million extremely low-income renter households and only 6.2 million homes with rents these families can afford. Consequently, 71% of extremely low-income renters spend more than half of their income for housing, leaving them without enough money for other essentials and at high risk of losing their apartments and joining the ranks of the homeless. Hawkins noted that there were more than 77,000 renter households in the 25th district, with about 20% of them "severely burdened."

Hawkins also supported an overhaul of the governmentís largest welfare program, namely allowing people to deduct their interest payments on their mortgages to banks and other financial institutions. The deductions primarily benefit banks and upper income households because many moderate and middle-income homeowners do not benefit from itemizing their deductions. But the mortage interest deduction inflates the cost of housing across the board by 20% or more, because since buyers are convinced to pay more for housing since they told they can afford it because they can deduct the interest from their taxes. The US is the only country that provides a tax deduction for mortgage interest. Hawkins says that this money would more equally benefit all Americans by being built into increased standard deductions for income taxes, effectively becoming a housing tax credit that could be spent for home ownership or for rent. In 2005, the taxpayer cost of mortgage interest tax deductions totaled over $122 billion, while HUD spending on affordable housing was only $31 billion -- a gap of more than $91 billion.