Hawkins Challenges Wall Street Bailouts as Solution to Home Mortgage Crisis

Howie Hawkins for Congress

25th District, New York

www.howiehawkins.org

Media Release

For Immediate Release: Tuesday, August 5, 2008

For More Information: Howie Hawkins, 315-425-1019, hhawkins@igc.org

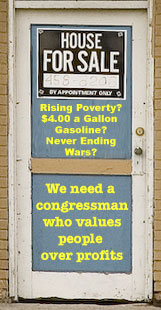

Howie Hawkins, the Green Populist candidate for Congress in the 25th district, today blasted Congress and President Bush for the mortgage relief bill enacted last week, saying, "It should have been titled the Wall Street Bailout and Taxpayer Giveaway Bill of 2008."

"The bill merely asks, but does not require, the bankers to refinance the mortgages of millions of defaulting families. Meanwhile, the Fed and the Treasury have given away billions to the rich, including $29 billion to JPMorgan Chase for Bear Stearns, $300 billion to buy up Fannie Mae stock to shore up its share prices, and virtually unlimited lines of government credit for insolvent investment firms and banks. But there are no bailouts for working people. They are going to pay and pay heavily for decades for this unprecedented bailout for the rich," Hawkins said.

Hawkins said that the subprime mortgage crisis, which the mortgage relief bill and the other government giveaways attempt to address, is just the latest example of how "the coupling of rampant political corruption to deregulation of markets has enabled special interests to rob the American public repeatedly. We should have learned from the Savings and Loan debacle how deregulation breeds corruption and subsequent bailouts two decades ago. Now we are being made to pay again for irresponsible financial gambling, only the scale this time is much, much greater."

Hawkins noted that "the members of the House and Senate who spearheaded this mortgage industry bailout bill received enormous campaign contributions from the financial industry." He cited the over $18 million in campaign contributions received by members of the House Financial Services Committee from financial services, insurance and real estate firms this year. On the Senate side, Hawkins noted that Senator Chris Dodd (D-CT) raised $4.25 million from securities and investment firms and Senator Chuck Schumer (D-NY) raised $1.4 million from securities and investment firms.

"Those campaign contributions are about the only investments the financial industry has made lately that earned positive returns. Unfortunately, this legalized bribery is not an investment that enables an expansion of the real economy, but merely legalizes an illegitmate transfer of assets from average taxpayers and borrowers to wealthy creditors," Hawkins said.

The new housing law authorizes the Treasury and Federal Reserve Board to provide unlimited credit to Fannie Mae and Freddie Mac, and infuse new lending power to the Federal Housing Administration (FHA) and localities to support the real estate market. Hawkins said "the bill bails out predatory mortgage lenders by substituting taxpayer funded government loans for the bad loans that the banking industry is stuck with."

Hawkins noted that mortgage defaults and foreclosures are destroying the collateral valuations for the loans packaged and sold to pension funds, other institutional investors and foreign banks including the $1 trillion in Fannie Mae and Freddie Mac securities to foreign central banks and sovereign wealth funds.

"The bill attempts to re-inflate housing prices and make the creditors whole with taxpayer subsidies. The increased funding for Fannie Mae, Freddie Mac and FHA are part of a $1.4 trillion emergency supply of government credit intended to keep housing prices from falling back to more affordable levels. The refinancing that struggling mortgage lenders get is like the refinancing that sharecroppers used to get from their landlords. They get indentured to their overpriced homes like sharecroppers got indentured to the land," Hawkins said.

"If taxpayers are going to invest trillions in real estate to stabilize financial markets, they should get ownership rights like any other smart investor. Fannie Mae and Freddie Mac should be restored to public ownership and management. The should be managed like the Home Owners Loan Corporation of the 1930s, which refinanced one mortgage in five during the Great Depression, saved a million homes from foreclosure, and turned the government a profit by the time it was closed in 1951," Hawkins said

"The purpose should be to save individual debtors from foreclosure and re-set their mortgages at more realistic levels. A maximum loan value of no more than 15 times the annual rent for comparable space in the local market would be a reasonable standard. Most lenders could afford that. The creditors would get a reasonable return for the real asset, but not the grossly inflated values of recent years," Hawkins stated.

"Similarly, when public money bails out failing banks, the public should its proportionate share of equity and management rights for its investment, just like other investors," Hawkins added.

"Instead of more bailouts for the rich and powerful, we need more indictments of corporate criminals for fraud and predatory lending. At best, the management of Fannie Mae and Freddie Mac were incompetent and their $12 to $20 million salaries are an outrage. They should be fired pending further investigations of their criminal liability," Hawkins said.

"Politicians of the major parties must also be fired in the next election for failing to do their job to protect American consumers and taxpayers. Unlike Democrats and Republicans, I believe that the financial regulatory framework we created after the Great Depression, which helped provide decades of financial stability, needs to be restored and updated to reflect the 21st century, not thrown into the trash as the special interests and their campaign contributors continue demand even in the midst of the worst financial crisis since the Great Depression," stated Hawkins.

Hawkins said that in addition to restoring such New Deal regulations as the separation of commercial and investment banks, "It is time to go beyond the New Deal with a more democratically accountable regulatory framework, starting with the Federal Reserve. The Fed must become a public agency that is transparent and democratically accountable. It should be an agency within the Treasury Department instead of public/private hybrid in which the private banking side dominates. Its mission should be to use monetary policy not only to moderate inflation, as it does now, but also to promote full employment."

Hawkins noted that federal regulators and public officials repeatedly ignored the warning signs about the housing price bubble and the role that subprime mortgages were playing, including widespread evidence of predatory lending practices.

Hawkins said his Congressional opponents "fail to articulate the basic changes in economic policy needed to avert economic collapse. Without deep cuts in military spending and progressive tax reform that makes the rich pay their fair share, the growing federal, state, and local fiscal deficits mean further economic contraction and the further erosion of what remains of public services and public assistance to those in need. High energy costs, the peaking of global oil production, the global food crisis, and, above all, the accelerating climate crisis mandate massive public investment in a new infrastructure for solar-powered sustainability."

Hawkins noted that profits in the financial sector accounted for around 15 percent of total profits in the post-war period before 1970 and had grown steadily to over 40 percent of total profits by the 2000s. "The financial sector used to facilitate production. Now it is a parasite on the real economy of labor and industry. We need to re-regulate the financial sector so it, in concert with increase strategic public investment, can serve the real economy of production. The way to get the economy going again and put people back to work is massive investment in a new real economy based on principles of ecologically sustainable production," Hawkins said.

"It is time for our political representatives to reject dogmatic blind faith in unregulated markets. Unregulated markets are less efficient than well-regulated markets and they provide too many opportunities for greedy operators to rip-off the public. Deregulation of the electrical industry led to a high-stake poker game, with companies like Enron manufacturing blackouts to send the price of electricity and their profits soaring. Political leaders were well rewarded to also look the other way when Wall Street sharpies hustled new financial securities based on overpriced housing mortgages that even senior partners at major Wall Street firms admitted they couldn’t value with any accuracy. Both parties in Congress approved huge tax cuts for the rich while throwing hundreds of billions away on war, unneeded pork barrel weapons systems, and a military budget so bloated it cannot be audited with any accuracy, enabling massive theft by military contractors. The fiscal shenanigans of the Bush administration, the Federal Reserve and Congress has caused the value of the American dollar to plummet, which has greatly contributed to the rise in the price of gas and other commodities and imported goods. For the second time in less than a decade middle class Americans sees the value of their private retirement plans radically reduced. Now their home equity is plunging, too. Bailing out the Wall Street financiers who are responsible for this crisis is an outrage," added Hawkins.

"There has been a bipartisan effort to allow for the wholesale looting of American taxpayers. But when the criminal scheme comes crashing down, the politicians trip over themselves to bail out the rich while ignoring the plight of low and middle-income Americans," noted Hawkins.